- What Constitution?

- What religious liberty?

- Health care law is one hell of a tax

- Tax reform

Some interesting and timely reads from both The Federalist and The Heritage Foundation. The entire articles are recommended for their many additional points. Content in bold our selective emphasis.

Who Needs Courts Or Congress When You Have President Obama?

Who Needs Courts Or Congress When You Have President Obama?

Liberals love America’s checks and balances when the system works for them. But just let courts interfere, and they’re immediately illegitimate. From Shawn Mitchel writing at The Federalist:

Excerpts:

Legal commentator Jeffery Toobin’s recent piece in The New Yorker, “The Threat to Obama from the Courts,” deserves nomination for Best Hack Performance in a Presidential Supporting Role. Toobin makes clear his take on the final years of this presidency: Obama’s aims are laudable and good for the nation, while conservatives’ aims are suspect and center mainly on tarnishing Obama’s legacy and denying Mount Rushmore a chisel-ready project for January 2017.

In making his case, Toobin all but declares checks and balances on government power are not a crowning feature of America’s constitutional formula, but cumbersome relics handed down by Founders who surely would have done better if they had foreseen a leader like Obama. . . .

Those Darned Courts and Their Concern for Legality

Toobin describes the plaintiffs’ argument in King v. Burwell, an Obamacare case, as asserting that “four words in the text of the statute” mean that people in 34 states are ineligible for the Affordable Care Act’s federal subsidies. He discernibly shouts, “That’s ridiculous! What could be more trifling than four little words?” Presumably, Toobin would argue for executive flexibility in interpreting the difference between “the Secretary shall” and “the Secretary shall not” because after all, the difference is but a single word.

Will We Surrender on Religious Freedom? Ed Feulner writing at The Heritage Foundation’s The Daily Signal:

“They won’t go to Indiana, but they will go to Saudi Arabia.” That’s Carly Fiorina speaking about Apple CEO Tim Cook and his well-publicized opposition to Indiana’s religious freedom law.

Fiorina, a former CEO herself, was underscoring what she quite rightly views as hypocrisy. Here Cook is, excoriating Indiana lawmakers for protecting the freedom of business owners to act according to their consciences. Yet he has no qualms when it comes to doing business in countries where homosexuality is a crime punishable by death.

The Logic Of Economic Discrimination If Apple can boycott Indiana, why can’t evangelicals boycott same-sex weddings? Writes Jordan J. Ballor at teh Federalist:

Such boycotts, however, are fundamentally based on discrimination. Executives like Cook and Oesterle don’t like what Indiana has done, and they have decided to limit business transactions with those that they find problematic, whether morally or otherwise. Ryan Anderson of the Heritage Foundation powerfully summarizes this dynamic: “Businesses are saying they’ll boycott Indiana over this religious liberty law. So they want the freedom to run their businesses in accordance with their beliefs—so they’ll boycott a state that tries to protect that freedom for all citizens? Do they not see that the baker, photographer and florist are simply asking for the same liberty?” . . .

Such boycotts, however, are fundamentally based on discrimination. Executives like Cook and Oesterle don’t like what Indiana has done, and they have decided to limit business transactions with those that they find problematic, whether morally or otherwise. Ryan Anderson of the Heritage Foundation powerfully summarizes this dynamic: “Businesses are saying they’ll boycott Indiana over this religious liberty law. So they want the freedom to run their businesses in accordance with their beliefs—so they’ll boycott a state that tries to protect that freedom for all citizens? Do they not see that the baker, photographer and florist are simply asking for the same liberty?” . . .

Also at issue in these debates is the fundamental freedom of association. When government power is used to coerce economic exchange, there ought to be a significantly convincing reason to do so. Otherwise, the presumption should be in favor of liberty and the burden of proof should lie on those who want to compel exchange.

Now it is also true that not all discrimination is created equal. But the key to a reasoned and morally-responsible discussion about good, bad, or permissible forms of discrimination depends on recognizing and acknowledging the inherently discriminatory nature of moral, economic, and political choices.

The starting point must be the presumption of such liberties, and there must be a higher standard of proof for those who would infringe those freedoms. The logic of economic discrimination runs both ways, and such give-and-take is absolutely indispensable for a truly free and prosperous society.

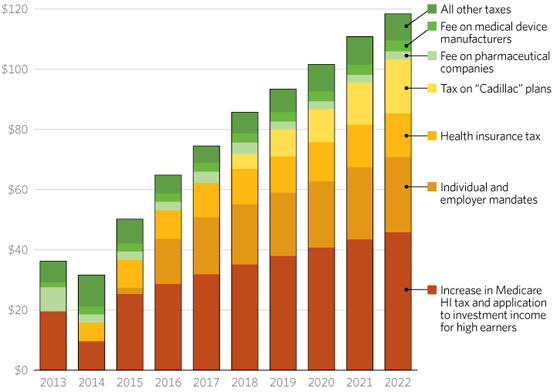

Obamacare’s $800 Billion Tax Hike Explained in One Chart Alex Rendon, also at the Heritage Foundation, provides this painful however timely chart of the TAX INCREASES as a result of Obamacare. Reprinted here in its entirety with permission.

April 15 is right around the corner, and millions of Americans will find themselves paying more in taxes than ever thanks to Obamacare.

The law is more than a fundamental change to the country’s health care system. It also is a massive tax hike. As The Heritage Foundation’s Federal Budget in Pictures shows, according to the most recent scores, Obamacare will increase taxes by nearly $800 billion for the period of 2013-2022.

Obamacare contains 18 separate tax increases. A few of the biggest include a tax on “Cadillac” health insurance plans, which doesn’t take effect until 2018, long after President Obama and many in Congress who voted for the tax in 2010 have departed Washington. Also, there is a tax on health insurance premiums and a higher rate on the Hospital Insurance payroll tax for single filers with incomes above $200,000 ($250,000 for married filers) that also applies to investment income.

At a time when the already-onerous tax code has created a significant drag on the economy, Obamacare’s tax hikes only do more damage. Many Americans have found themselves afflicted by higher health insurance premiums, driven up, in part, by new taxes on insurers. Increased rates on capital gains and dividends from the wage and investment tax hike discourage saving and investment, resulting in fewer jobs created and lower wage growth.

Because of Obamacare, Americans are paying much higher taxes and those taxes are hurting the economy. Though some bipartisan efforts exist to repeal some of the new taxes that benefit special-interest groups, including the medical device tax, an incomplete approach won’t be sufficient to overcome the detrimental effects of this law.

Congress should repeal Obamacare and all of its tax increases.

To learn more about federal spending, the national debt, and taxes, visit the 2015 Federal Budget in Pictures.

The Fair Tax proposal to replace the income tax has been something we have favored as fundamental tax reform for a number of years. Curtis Dubay writing at Heritage Foundation offers that Congress Can Raise Your Income 10 Percent By Updating the Tax Code

Congress could raise your family’s income by 10 percent, or maybe even more. And it could do it with a policy reform that has the support of 71 percent of the American people.

Congress could raise your family’s income by 10 percent, or maybe even more. And it could do it with a policy reform that has the support of 71 percent of the American people.

Even better news is this is not some big-government spending program that would deliver a 10 percent raise. Instead, it’s tax reform.

The Tax Foundation, in a recent study, found that if Congress implemented a consumption tax, the economy would grow by 15 percent and wages by 10 percent.

Whether The Fair Tax , a flat income tax, or the concept of Neutral Tax ( a proposal to have the states finance the Federal government with a flat tax revenue on money they receive, however they choose to raise it) this country is way overdue for ending the bureaucracy and horrors of our current federal income tax system.

R Mall

cute! since the CBO disagrees w U. AHCA does not hurt the economy. and for the middle class, AHCA taxes are shouldered by the rich, to raise 30+ billion $$$ over the next TEN years. so, U R wrong…yes, Obamacare is here to stay. about 25,000,000 signups by 2016. and what a shame now, insurers can no longer DENY coverage on precondition Cancer and MS cases. your Hate Crusade is true joke…it’s only good for raising money for Haters who will certainly lose in ’16.